About 59 million people currently rely on Medicare. And that number is expected to increase to almost 80 million in the next 10 years.

If you or someone you care for is part of that group, you can start learning more about Medicare today.

The more you know about your Medicare benefits, the easier it will be to navigate the healthcare system.

Read below for an easy-to-understand guide to each part of the Medicare system.

Medicare

Medicare is a form of health insurance issued by the federal government. It is intended to help people cover costs for medical care.

Medicare is similar to other types of private health insurance you may be familiar with. However, to be eligible for Medicare you must be 65 years or older or meet certain disability requirements.

You can enroll for most Medicare benefits up to 3 months before and 3 months after the month of your 65th birthday.

You can also change your Medicare Advantage or Medicare part D elections during AEP the Annual Enrollment Period. AEP is typically from the middle of October to the middle of December.

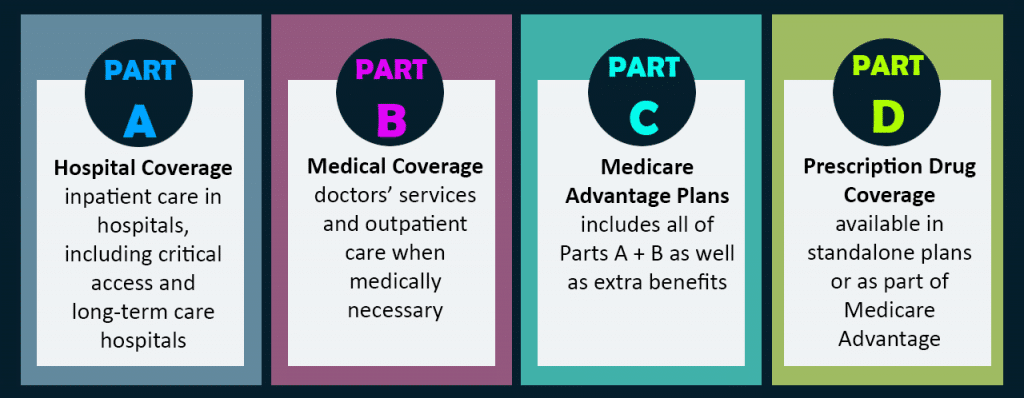

Medicare is divided into four parts: A, B, C, and D. Keep reading to learn more about each part.

Medicare Part A

Medicare Part A is sometimes called hospital insurance. This insurance covers short-term hospitalization or nursing care. If you are over the age of 65 and have contributed to Social Security, you are eligible for Medicare part A.

Part A covers care in a skilled nursing facility or hospice care. If you are disabled or require highly skilled care from a nurse or health aid, this coverage is essential. Hospice care and home health care are also covered by Part A.

You can enroll in Part A up to 3 months before and 3 months after your 65th birthday. This is sometimes referred to as the Initial Enrollment Period. If you apply to receive Social Security benefits you are automatically enrolled in part A.

The cost of Part A varies. If you or your spouse contributed to Social Security for at least 40 calendar quarters (about 10 years), you do not have to pay a premium for Medicare part A.

If you have not paid Social Security taxes for that amount of time, you will be required to pay a premium of up to $458 per month. The Medicare Part A deductible is $1,408, but total costs vary from year to year.

Medicare Part B

Medicare Part B covers general medical services from a primary care doctor or other health care provider. It also covers some medical equipment, mental health services, and preventive care.

Premium costs for Medicare Part B vary based on your income. The government will use tax return information from the last two years to determine your premium cost. You can expect to pay about $144.60 per month according to recent data.

The average deductible cost is about $198 in 2020. After your deductible is met, you will likely pay 20% of the total amount approved by insurance.

The eligibility period for Part B is the same as part A and you are automatically enrolled if you apply for Social Security benefits. You may defer Part B if you continue to work and keep your Employer Health Insurance.

Medicare Part C

Medicare Part C is often called Medicare Advantage. It replaces the coverage from Parts A and B. When people refer to original or traditional Medicare they are usually referring to Parts A and B only.

You can think of Part C as a package of all the benefits from Parts A and B including hospital care and regular medical visits.

The “advantage” of Part C is that it also covers medical costs from vision, dental, and hearing. However, the cost of Part C varies drastically between plans and location.

You can choose whether you want to enroll in Medicare Part C but you have to have parts A and B first. Then, you can enroll in Part C using a private insurance company. Your payments are made to that insurance provider.

The enrollment period for Part C is the same as Parts A and B within 7 months of your 65th birthday but you will not be automatically enrolled for any reason.

Medicare Part D

Medicare Part D applies to prescriptions. You can search online to determine whether your prescription drug is covered by Medicare.

Premium costs are varied by plan, because the formulary of drugs differs on each plan. There may be co-payments required for generic and name-brand drugs.

Enrollment for Medicare Part D is the same as parts A, B, and C. You must enroll with an private insurance company.

Since the Affordable Care Act, individuals with Part D have had to pay less for prescription drugs. Hopefully, that trend will continue.

Choosing the Plan That’s Right for You

That was a lot of information. But choosing a plan doesn’t have to be difficult. Take time to create a budget for health care expenses. What can you afford to pay out of pocket?

Then, think about the healthcare services you use most often or anticipate using in the future. Will you need to fill certain prescriptions? Will you need home health care or a longer-term care service?

Answering these questions will help you decide which parts of Medicare you are best suited for. If you need additional support deciding on your Medicare plan, take a look at this guide.

You may also be interested in purchasing Medigap insurance (also known as supplement insurance), which can cover leftover expenses.

Let Medicare Care for You

The purpose of Medicare is to help older adults and the disabled afford the medical care they need. Each part mentioned above serves a different role in covering medical expenses.

To be prepared, research your options and decide on your enrollment before your 65th birthday. Remember that you can enroll up to 3 months prior.

Choosing the right insurance depends on your needs and your budget.

If you have any Medicare insurance questions or concerns, you can contact us for a free consultation.

Pingback: 5 Essential Facts About Final Expense Insurance in Pace, Florida - NW Florida Medicare